Thank you for your interest in our Banking Through the Generations eBook!

Introduction

“Are these payment platforms really safe?” one of the parents wonders aloud.

Meanwhile, the Millennials at the table shake their heads at both older generations. They tried Mom and Dad’s bank but ultimately decided they needed an institution with better digital self-service. Checking balances, transferring funds and paying bills online are the basics; the Millennials want the ability to perform more complex tasks – including applying for loans – without speaking to another human, much less visiting a branch.

“Who wants to actually talk to a customer service rep, anyway?” the Millennials wonder silently.

This fictional family accurately illustrates the breadth of financial services consumer behaviors and preferences. How can financial institutions meet such diverse expectations? How can they feed some customers’ appetites for in-person, high-tech service while still delivering convenient, personalized self-service experiences that younger customers demand?

A New Wave of Banking is Here

Statistics prove that banking is in a new era. Gartner predicts that digitalization will make most heritage financial firms irrelevant by 2030. Equally jarring is another survey that found more than half of potential switchers are open to using alternate providers, such as Amazon, Facebook, Apple or Google, as their primary financial institution. That finding held true across generational boundaries, not just among younger consumers.

In short, now is the time to set the table for real change – starting with a fresh approach to mobile experience. In reimagining their mobile experience, banks and credit unions must think about multi-generational customer expectations and balance the urgent requirements of today with the need to build a strong yet flexible foundation for the future.

Making Mobile Banking Meaningful

If you don’t yet have a mobile app, launching one is a great first step. If you have digital banking, also known as neobanking, capabilities look into what you could do to improve your user experience. And if your business is already a mobile banking pro, how else can you offer Gen Y and Gen Z what they’re looking for digitally? Have you tried using voice to make it easier to find branch locations, check balances and make payments?

In this eBook, we’ll take a closer look at each of the four generations (Baby Boomer, Gen X, Millennials, and Gen Z), share some industry research on their preferences and behaviors, and explore how those trends might inform an effective digital banking strategy.

Baby Boomers

Baby Boomers, born between 1946 and 1964, are the largest generation in the US. Are you prepared to meet their banking expectations?

What’s more fun: contacting your bank or going to the dentist?

US financial services institutions want Baby Boomers as customers. Why? Because Boomers are the wealthiest generation in the United States and are poised to stay that way until at least 2030. Yet, creating services that are appealing to Boomers, as well as the generations that follow, can be challenging.

Our deep dive into this generation led us to one conclusion: Boomers cannot be ignored. Consider these facts:

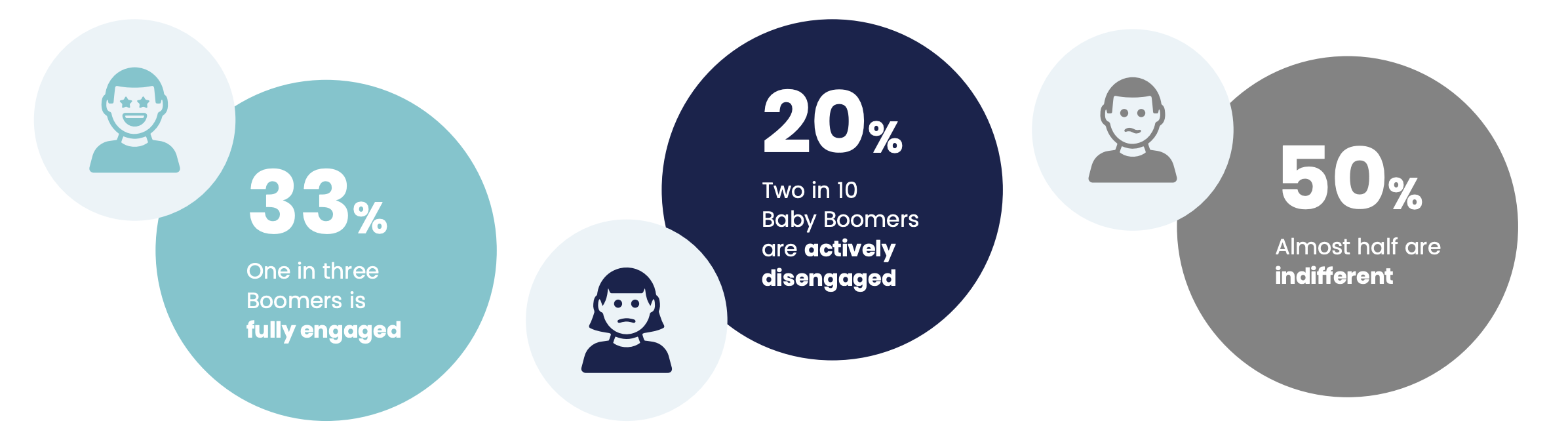

Baby Boomers’ emotional connection with primary banking providers

Boomers have low involvement with their financial institutions. Gallup’s study of customer engagement found that just one in three Boomers is fully engaged – meaning, they have an emotional connection – with their primary banking providers. Add to that two in 10 Baby Boomers are actively disengaged, and almost half are indifferent.

Baby Boomers value engagement

A customer experience study found that Boomers are the least forgiving generation: 44% would walk away from a company after one bad experience. (FYI: Gen Z was the most forgiving, with only 22% saying they’d bail after one negative encounter.) What’s more, the same study found that one-third of Baby Boomers equate contacting customer service to stubbing their toe or going to the dentist. Ouch!

The Time to Enhance Engagement is Now

A 2019 Pew Research Center study found that 68% of Boomers own a smartphone (up from 25% in 2011). It would seem that Baby Boomers (like Grandma Flo) are more than willing to embrace new technologies. But many can be impatient and inflexible when it comes to customer service. Thus, institutions seeking to woo Boomers would be wise to focus on improving customer service delivery.

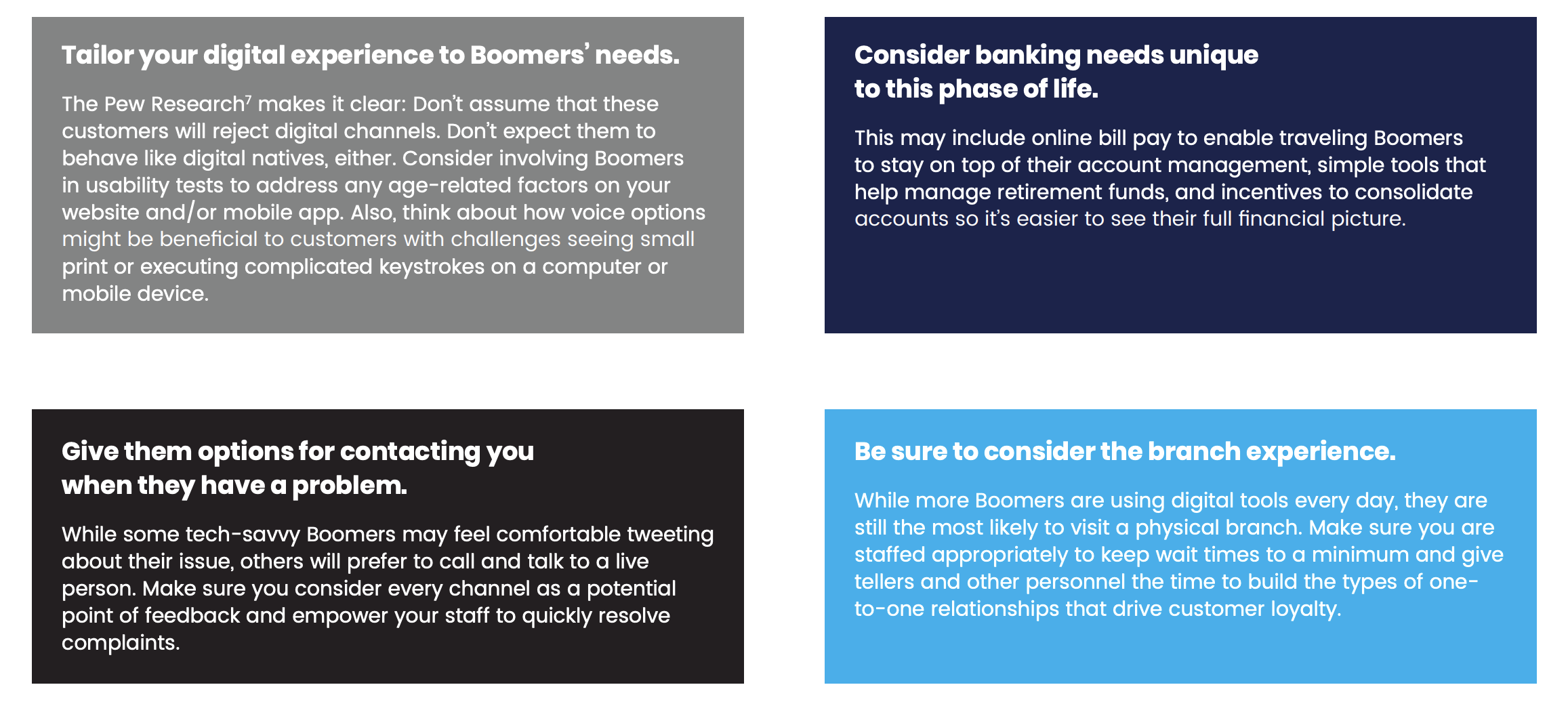

How to create meaningful experiences for Baby Boomers

To drive higher engagement with Boomers, consider the following:

Generation X

Next, let’s take a closer look at Generation X, share some industry research on their preferences and behaviors, and consider how those trends could shape an effective mobile strategy.

Born between 1965 and 1980, Gen X is hitting their peak earning years right now. Don’t miss the mark.

Gen X is stuck in the middle. Will they stick with you?

Generation X got its name because it has always lacked a strong collective identity. But with this cohort hitting peak earning years – and poised to take over everything from corporations to Congress – banks and credit unions need to dive deeper into how to attract, serve, and retain Gen X consumers.

It’s safe to say that Gen Xers are stuck in the middle. Demographically, of course, they are younger than Boomers but older than their Millennial and Gen Z counterparts. Like their elders, they’re not opposed to visiting brick-and-mortar banks; like younger consumers, they prize brands and companies that align with their values. And they’re highly attached to their smartphones, spending 21 hours per week on their device vs. 19 hours by Millennials. In fact, Gen Xers are some of the most voracious users of social media (logging seven hours a week) and checkers of email (spending five hours a day between work and personal accounts).

Supporting Gen X with their dependents: Baby Boomer parents and Millennial and Gen Z children

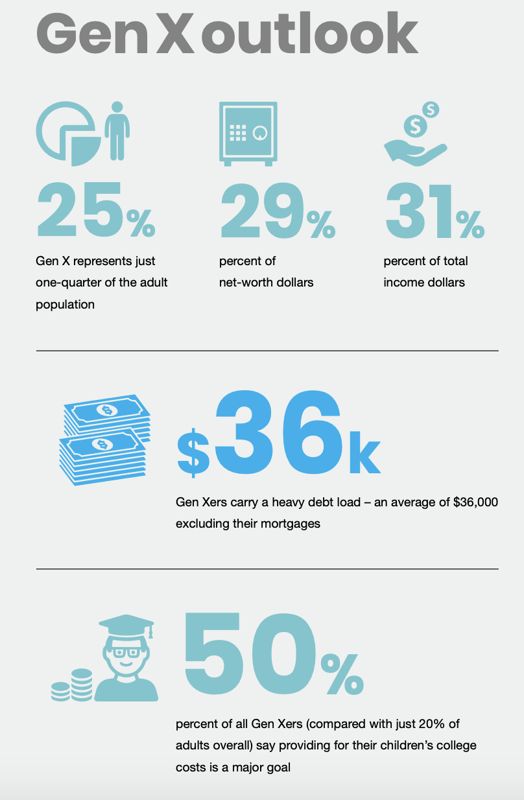

Generation X is stuck in the middle in another significant way: according to Pew Research Center, 47% of adults in their 40s and 50s have a parent 65 or older while also raising a young child or providing financial support to a grown son or daughter. Being pulled in multiple directions can take a toll. Perhaps that’s why Gen Xers carry a heavy debt load – an average of $36,000 excluding their mortgages – despite being in the prime of their careers.

That isn’t to say they don’t have money to spend, save, and invest. Indeed, they have disproportionate spending power, representing just one-quarter of the adult population but with 29 percent of net-worth dollars and 31 percent of total income dollars. A Shullman Pulse study commissioned by American Express found that Gen Xers prioritize saving, including for their children’s college educations. And they’re more likely than other groups to prioritize financial goals, like buying a house, starting a business, and leaving a legacy to their heirs.

Meet Gen X where they are

How can banks and credit unions capture the hearts and minds of these stuck-in-the-middle consumers? Meet them where they are – in every sense of the phrase:

Millennials

Moving to the next generation, we’ll discuss some of the distinctive needs and opportunities facing Millennial banking consumers.

Born between 1981 and 1996, Millennials are the first generation to have lived with technology for their entire lives. Their expectations are much higher, and if they don’t get what they need from one company, they’ll quickly move onto the next one who can support their demands.

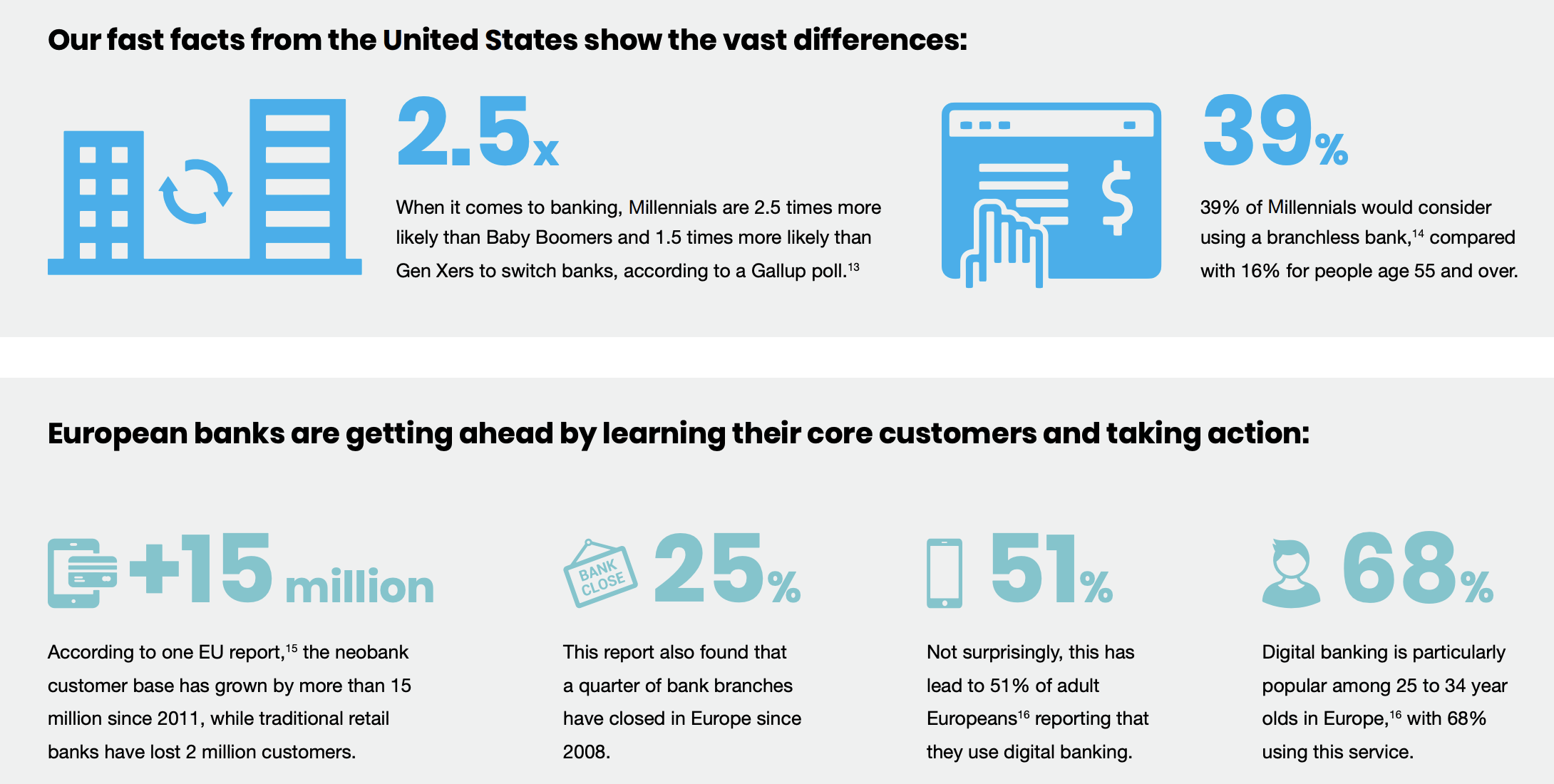

Neobanking and Millennials: a global outlook

The financial services industry is increasingly becoming more hard-pressed to uncover how they can earn the business of Millennials, who are quite different from the generations preceding them.

Millennials demand digital

There are 7.7 billion Millennials worldwide and they are a force to be reckoned with. Having so much technology already at their fingertips, banks will be forced to meet them online, on their mobile devices, and over the cloud.

Earlier in this eBook, we discussed whether baby boomers find contacting their bank more or less fun than going to the dentist. Ironically, 71% of Millennials reported that they would prefer visiting a dentist over listening to what a bank has to say. Yikes! While this statistic may be intimidating to banks and financial institutions, we actually think it gives them a launching pad for finding new ways to reach Millennials, especially as the global trends for digital banking skyrocket.

The proof is in their behavior

Digital and technological advancements have always been a part of Millennial life, in fact, they expect their banks to keep up with the trends.

Millennials are getting digital and tech-savvy with their banking:

Before you go digital, your innovative ideas should have a strategy

Leadscon found that 14% of Millennials prefer to conduct banking activities in person, you can’t simply throw together a digital solution and call it a day. You have to create a real strategy around innovation, otherwise you’ll see users jump ship. In another survey conducted by leadscon found that 38% of Millennials abandoned mobile banking activities when they took too long, highlighting the importance of customer experience. It’s also important to utilize digital tools to highlight any rewards programs that differentiate your bank - a Kasasa survey indicated that 83% of Millennials would switch banks for better offers.

With so many factors at play, neobanking solutions are a trend that financial institutions should seriously consider if they are evaluating new ways to recruit Millennials, but not without the proper strategy and implementation plan.

Generation Z

In our final chapter, we’ll talk about Gen Z, the youngest generation of bankers entering the market.

Born between 1997 and 2012, Gen Z is the youngest generation of banking consumers, and they’ve never known a world without innovation. Banking institutions must prepare now to not meet their needs, but exceed them.

Get ready for the Gen Z boom

For Baby Boomers, TV changed everything. For Generation X, it was personal computers. And for Millennials, it was the rise of the Internet. People in Generation Z have never known a world without all of those innovations. They are the ultimate “digital natives.” And their numbers are massive, with Gen Z poised to overtake Millennials as the largest US cohort by 2034.

No one yet knows the full impact of growing and developing amid a constant stream of digital technologies. But every financial services institution needs to understand that Gen Z customers will mean the difference between success or struggle in the not-sodistant future.

Let’s dive into some highlights of what banks and credit unions need to know.

Two important considerations

Great news: the gap between Millennials and Gen Z is small

There’s been no shortage of chatter about generation gaps between Boomers, Gen X , and Millennials and how those gaps affect workforce dynamics and economic trends, including consumer preferences. When it comes to Millennials and Gen Z, the Morgan Stanley study found real synergies between these generations.

Together, Millennials and Gen Z will create what Morgan Stanley calls a “youth jolt” beginning in the mid-2020s. They will “power higher consumption, wages and housing demand, all pillars of GDP growth,” according to the report. And they seem to share mostly similar views when it comes to education and values. In other words, it should be a pretty smooth transition when Millennials pass the torch to Gen Z – whether in the workplace or as financial services customers.

So as financial institutions shore up their value props for Millennials, that work can lay a strong foundation for the customers coming soon after. Give both of these “youth jolt” generations digital-first experiences. Speak to their values. Make experiences social. Above all, prepare to keep changing as their needs evolve over time.

The Time to Invest in Digital Banking is Now

As you can see, no matter what generational demographic your customers fall into – whether it’s one or all four – digital banking is becoming the new norm around the world. Financial institutions must adapt or be willing to let go of lifelong customers searching for better options. If you’re ready to start thinking about how you can better meet the needs of your customers and provide them with enhanced experiences, let’s talk.

Other Sources:

Give us your information below to start the conversation.