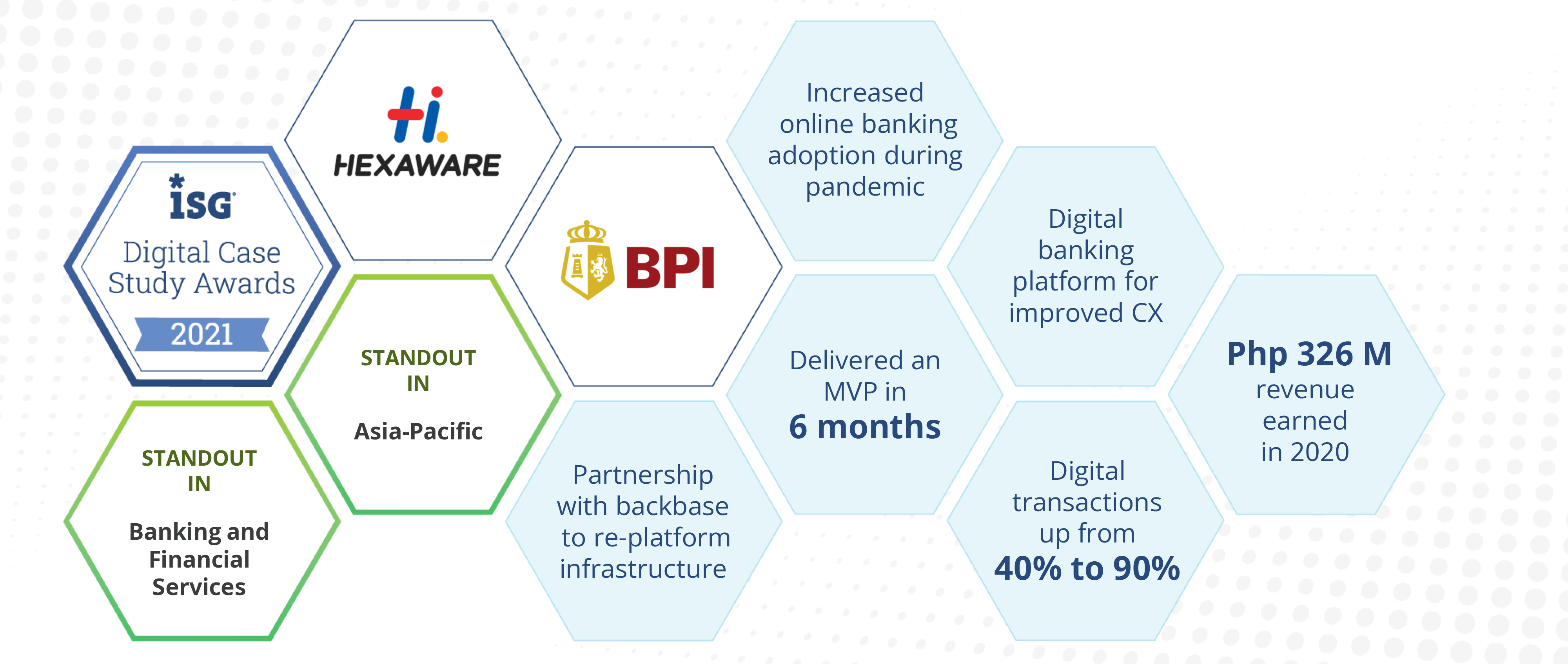

ISG recognized Hexaware (parent company of Mobiquity) with four standout client case studies for which they awarded the 2021 ISG Digital Case Study Awards as a result of the best-in-class digital transformation work with enterprise customers.

The winning case studies were: City of Aspen, HNI, Studio and Bank of Philippine Islands (BPI). These top case studies were chosen from a record number of provider submissions—nearly 250—that show a majority of digital transformation initiatives were focused on improvements in customer and user experience, with the related goal of driving top-line revenue growth.

“The past year was not a drill. It was the ultimate test for providers to rapidly help enterprises address the sudden and massive requirement changes brought on by the pandemic,” said Paul Gottsegen, partner and president, ISG Research and Client Experience. “It’s been amazing to witness the entire provider community step up to that challenge, and with so many strong entries to choose from, we’re privileged to pay tribute to the best of the best.”

The partnership between Mobiquity (Hexaware's Customer Experience Transformation Line) and Bank of the Philippine Islands (BPI) was awarded with two ISG Digital Case Study in Banking and Financial Services and in Asia Pacific.

Case Study: Digital banking platform launches in time to address usage surge.

Opportunity

The Bank of the Philippine Islands wanted a seamless digital banking platform to improve customer experience across their online and mobile channels. At the time of the coronavirus pandemic, the system in place had to be ready to support BPI’s customers as they became more reliant on online banking.

Imagining IT differently

The Bank of the Philippine Islands partnered with Mobiquity - Hexaware's Customer Experience Transformation Service Line.

For the solution, Mobiquity partnered with Backbase to re-platform the bank’s web and mobile infrastructure, enabling the bank to offer important new tools to customers. From biometric login to digital wallets, these features empowered Filipinos to bank however they wanted, wherever they were.

The minimum viable product was delivered in just six months and was followed by an incremental rollout of new features from 2017 through the current period.

Future Made Possible

Customer adoption is the real indicator of success.

Before the pandemic, about 40% of BPI transactions were digital, and that rose to 90%.

With new revenue streams enabled by the platform, online and mobile banking platforms earned around 326 million Philippine Pesos from transactions done in the year 2020.

This partnership with Hexaware and Mobiquity, according to ISG, exemplifies the value of customer experience and its role in a digital operation model for an enterprise.

Give us your information below to start the conversation.