The European Commission has recently proposed a framework for a European Digital Identity which will be offered by Member States to their citizens at national level, will allow Europeans to store identity related data and official documents (such as driving licences, passports, educational qualifications and even COVID-19 vaccination details) in a digital format. This data can then be used as a digital proof of identity across Member States to enable citizens to access public and private services, ranging from renting a car or apply for a mortgage.

Datakeeper, a tech start-up powered by Rabobank, worked with Mobiquity to develop and launch a personal identity wallet app to improve the customer experience of purchasing and registering for products and services securely, while providing customers with full control over their personal data.

The launch comes after an announcement made by the European Commission proposed a framework for a secure European Digital Identity for all Europeans, in compliance with the General Data Protection Regulation law (GDPR).

The launch comes after an announcement made by the European Commission proposed a framework for a secure European Digital Identity for all Europeans, in compliance with the General Data Protection Regulation law (GDPR).

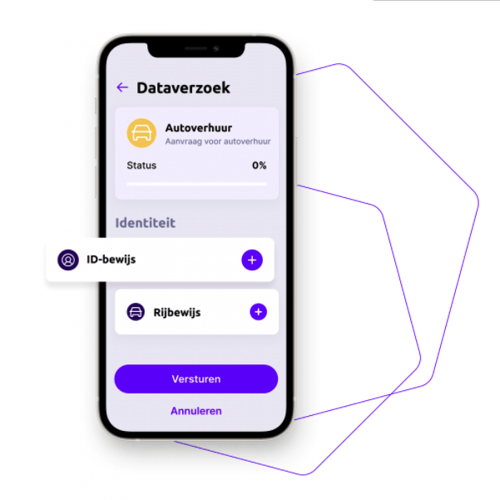

Datakeeper’s response is an app that facilitates identification, data sharing and electronic signing in a safe, fast and secure process. The result is a digital identity solution in which validated data, such as identity and income, are safely and decentrally stored on a user’s own mobile device and nowhere else, eliminating the need to carry additional documents. The app provides users with full control, allowing them to easily share selected data with the parties they trust, minimizing the data being shared and therefore satisfying GDPR compliance. By using the app, customers, governments and social organisations will be able to access or share data through displaying a QR code linked to the identity wallet, giving them peace of mind that their data is being shared and stored securely. For instance, Datakeepers’s European users will be able to apply for live events like social housing without the need to show ID or risk their personal information.

In an increasingly digitised world, companies and individuals are sharing their personal information online more than ever. The app promises to enable users to combat the dangers of data sharing through easy, private and safe sharing of data in a way that works for them. The app answers the call made by Margrethe Vestager, Executive Vice-President of the European Commission in charge of Europe fit for the Digital Age, and Commissioner for Competition, for a framework that allows Europeans to “do in any member states what they could do at home”, safely and securely. Safety and privacy are at the heart of the app's creation in a digital age challenged by insecure data handling and processing, and its expansion promises to transform how citizens live and interact with their data.

Commenting on the launch, David Lamers, Chief Product Owner, Datakeeper, said:

‘’The potential market for privacy friendly data sharing and identity wallets is huge. Within two years, an identity wallet will be the common way to share a digital identity and personal information. Datakeeper has been a thought leader in the market for a few years now and we want to become a major player. We care about the privacy of our customers.’’

Commenting on the launch, Gregor van Waning, Strategy Director, Mobiquity, said:

’Datakeeper is a game changer for both consumers and organizations. It will change for the better the way consumers and organizations interact in all kinds of customer journeys in our society.’’

Commenting on the launch Professor Sally Eaves, Chair of Cyber Trust, Global Foundation of Cyber Studies said: “I believe today’s announcement represents a significant milestone in personal identity protection and heralds the rise of the identity wallet as the typical way to share digital identity and personal information within the next 24 months. And the why? Because trust is now the most valuable currency of our time. And when it comes to trust in data, from government to business, and from citizen to consumer alike, perspectives and expectations have rapidly evolved after a sustained period of digital acceleration and technological convergence right across the globe. And whilst data volumes have significantly increased this has also created data paradoxes where that data has either not been fully optimised to serve maximum value, nor been adequately protected when shared or stored. This has led to well publicised cybersecurity breaches and understandably heightened concerns around security, privacy and compliance, creating critical trust gaps alongside complexity in management too. This raises the critical question – whose data is it anyway?

“The European Digital Identity framework provides an indicator of the extent of the shift in the answer, seeking to put control firmly back in the data owners’ hands and optimise the experience and safety of data exchange. It proposes the enablement of individuals and organisations to link national digital identities with passports, drivers licenses or other forms of identification, whilst eliminating revealing any personal information that is irrelevant to the specific transaction or task at hand, from renting a car to opening a bank account.

“Datakeeper’s Digital Wallet app responds directly to this critical need – making your phone an identity provider that stores a verifiable record of yourself to facilitate a secure, fast and safe process of identification, data sharing and electronic signing, allowing people to fully authenticate their digital identity through their very own smartphones. With consumers hugely familiar with mobile phone use, this affords a strong security platform to enable a natural, seamless and user friendly experience, without creating additional points of friction, thereby affording security, integration and control by design. I believe personal, decentralized, or self-sovereign identity represents a transformational innovation leap and this is a timely example of leadership in this space that can afford shared value benefits for customers, governments and social organisations alike.”

Leave your details below and we'll be in touch soon.