In today’s digitized world, the bank wants to make a difference and help people adapt to rapidly changing realities. Their work is geared towards creating and enhancing peace of mind for their clients through user-friendly, secure services into their personal and business finances. They want to offer customers 100% digital convenience of a fully digital banking experience. The bank has a need to accelerate innovation and develop small market value propositions by innovating faster, cheaper and better.

The bank turned to Mobiquity to create a solid basis for an innovation factory to enable accelerated innovation. Mobiquity’s innovation teams carried out full innovation cycles, covering problem and solution validation via rapid client experiments, prototyping and building of an MVP.

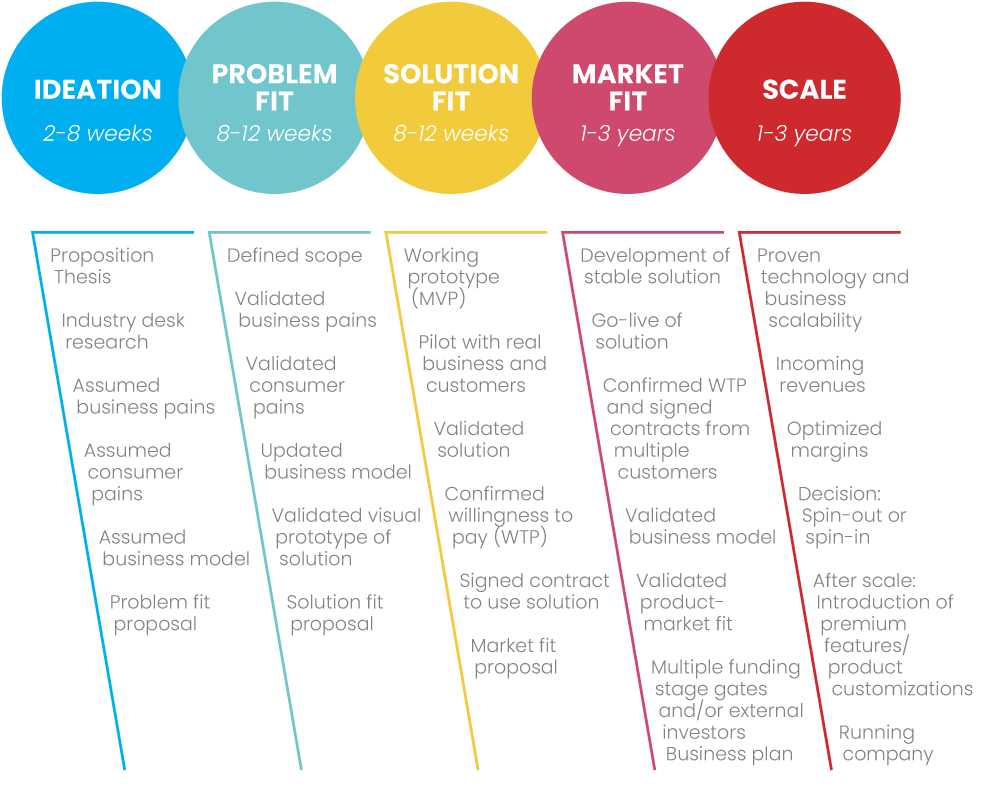

Mobiquity is involved in the phases of Ideation, Problem Fit, Solution Fit, Market Fit and Scale across all business lines: retail, wholesale and corporate. The role of the mobiquity teams is to deliver innovation while enabling the bank’s innovation team with the latest skills, practices and toolsets.

Soon after the innovation factory was set up, the innovation team from Mobiquity worked closely together with the client on a digital identity and personal data sharing idea. The solution offers people full control of their personal data in any kind of life situation: getting a mortgage, renting a car, buying tickets or even sharing corona test results. The solution is built on the principles of Privacy by Design and Self Sovereign Identity. The user is in control and can track which personal data is shared with which company. Through the use of data minimization techniques only the bare minimum is shared to protect the user’s privacy. At the same time companies greatly benefit because all received data is already verified on its authenticity which prevents fraud and time-consuming data checks. By using this solution, companies can offer more user friendly, safer customer journeys with less cost.

Over the past 3 years, the teams have been working on 15+ value propositions moving through the innovation phases. These propositions will potentially bring innovations to the market across multiple industries. A handful of these innovations have gained traction in the market and are currently in scale phase.

The digital identity and data sharing solution has a.o. already been selected by a large events organiser in the Netherlands and 8 successful pilots have enabled groups of people to attend the first large postpandemic cabaret, sport and music events. All attendees were safely tested and have digitally proven that they are covid-free before entering the events. In addition to this, other results show increased customer satisfaction, reduced friction and fraud. To the innovation factory this solution has proven accelerated digital innovation from idea to real product value.

Learn from our other client case studies: