Download our Interactive Digital Banking Features Radar

Our recent study shows that almost 80% of daily banking functionalities provided by banks to customers are similar, leaving only 20% for banks to differentiate themselves. As competition stiffens and the digital service offerings excel, pressure is on banks to provide bespoke value add features for customers. The challenge for banks is to focus their digital transformation budgets on the 20% of value-added functionalities to enable differentiation from the competition.

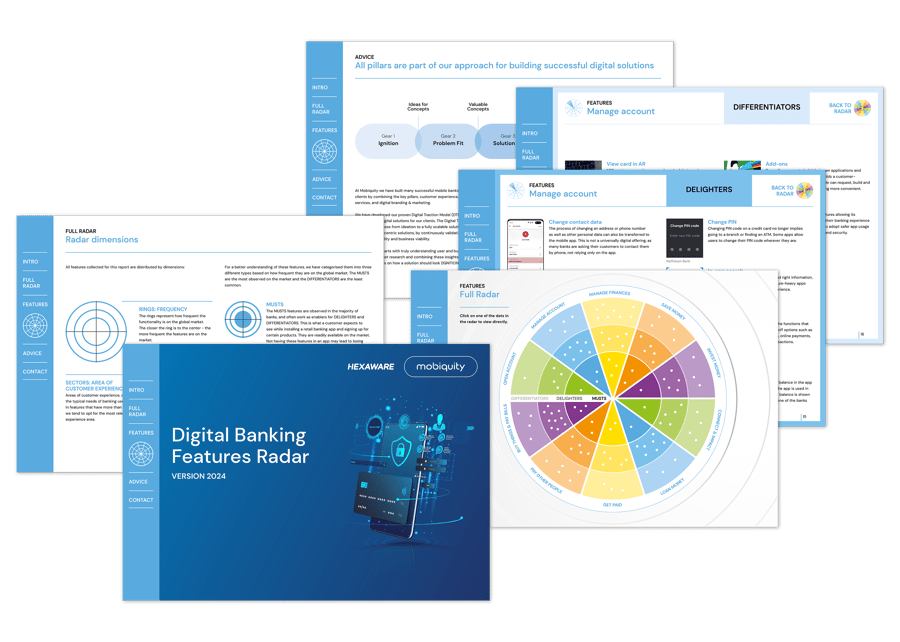

This report provides an overview of global mobile retail banking features, from over 80 banking and fintech apps worldwide, within an Interactive Digital Banking Features Radar. The radar provides details on the most commonly used features and which should be considered as a ‘hygiene factor’, which should be considered to delight clients, and which features would truly set you apart from the competition. It can be used as an inspiration for ideation sessions for new features, outlining key questions to consider. It provides an overview of how Mobiquity builds successful digital solutions by focusing on three key pillars in combination with our proven Digital Traction Model (DTM) to drive innovation.

How can you ensure digital success? By focusing on 3 key pillars; Customer Experience Strategy, Digital Products & Services and Digital Branding & Marketing. Truly successful digital products are rooted in human behaviour, emotions and needs. Product building evolves with the product itself, keeping investments under control and focusing on the value the solution brings to customers and businesses themselves. Great products need to be matched with great data-driven marketing.

At Mobiquity we have built many successful mobile banking applications for our clients by combining the three key pillars of digital success with our proven Digital Traction Model (DTM). Our approach starts with truly understanding user and business needs. The outcomes of this process are subsequently validated with users. We then prioritise proposed features based on technical feasibility and viability to build a Minimum Viable Product. The feedback received from users of the MVP is incorporated into a final version which is released to market, and the feedback process is continuously repeated to optimise the product for future scaling and releasing of new features.