The use of AI in banks has evolved significantly over the years, transforming data into valuable insights and powering applications like chatbots and automated advice. As technology continues to advance rapidly, a new frontier in AI has emerged: generative AI.

Generative AI refers to the remarkable capability of systems to produce original and creative content, including text, images, and even music, in response to prompts or descriptions. This groundbreaking development holds vast potential across various industries, particularly for banks, where it can revolutionise personalisation and enhance the overall customer experience.

To thrive in the digital era, banks must create these personalised and seamless experiences with customer expectations alignment in mind. Generative AI plays a crucial role in enabling banks to deliver this personalisation faster and more efficiently than ever before. By leveraging those language model technologies, banks can unlock the ability to tailor their services to individual customer needs, enhancing customer satisfaction and gaining a competitive advantage in the rapidly evolving digital landscape.

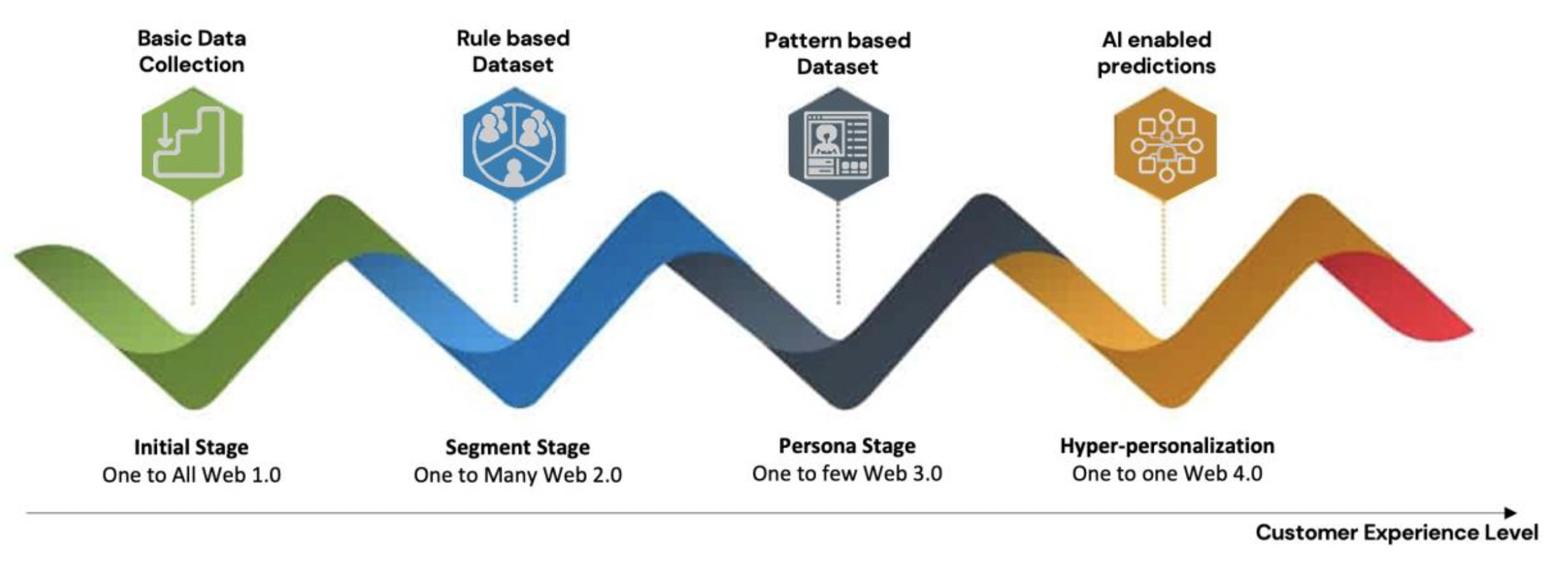

With the advent of the internet and digital interactions, customers initially accessed static, one-size-fits-all webpages. Over time, search engines, particularly Google and the emergence of web 2.0, became more advanced, enabling the identification of customer segments based on factors like region, age, and others. Today, with the rise of web 3.0 and social media, hyper-personalised content is already being created, and the future web 4.0 holds the potential to further enhance these experiences. However, traditional industries, such as banks, have not kept pace with the level of personalisation offered by social media.

From a maturity evolution point of view, the Web1.0 lies within this initial stage of product offerings, where one size fits all. That maturity evolves over time when data starts to enable banks to segment their customers, bringing one solution to many. In the near future, with Web4.0, banks will be unlocking the potential of hyper-personalisation, where the offering is tailored exclusively to that customer.

To understand the power of generative AI in transforming customer journeys, we first explore its impact in industries outside of banking. Examples from e-commerce, hospitality, and healthcare demonstrate how generative AI-driven personalisation, proactive service, and streamlined processes have improved customer experiences:

Generative AI shows great potential for enhancing customer journeys, as demonstrated by these examples above. Amazon's personalised product recommendations, Marriott International's AI-powered chatbots, and Medtronic's tailored treatment plans all showcase the power of generative AI in delivering proactive services, streamlined processes, and improved outcomes. By leveraging generative AI in banking, institutions will be able to provide personalised experiences, simpler operations, thus driving customer satisfaction and loyalty. Implementing AI-driven recommendations, virtual assistants, and customised solutions are already seen as requirements for banks to stay competitive and deliver exceptional customer experiences

In the banking industry, generative AI has the potential to revolutionise customer journeys. By harnessing vast amounts of data, generative AI algorithms can provide personalised financial advice, predictive insights, and contextually relevant experiences. We delve into the benefits of generative AI in automating routine tasks, reducing wait times, and enhancing self-service capabilities. The integration of generative AI technologies presents a tremendous opportunity for banks to create tailored, efficient, and delightful customer journeys.

Drawing inspiration from real-world implementations, we have selected some showcase examples below, that have successfully leveraged generative AI to enhance customer journeys, highlighting the adoption of generative AI-powered chatbots, virtual assistants, and personalised recommendations.

HSBC - Amy: HSBC has introduced Amy, a generative AI-powered virtual assistant that provides personalised financial guidance and assistance to customers. Amy assists users with tasks such as account management, financial planning, and investment recommendations. The implementation of Amy has resulted in improved customer engagement, reduced call centre volume, and increased customer satisfaction.

JP Morgan Chase - COIN: JP Morgan Chase has developed COIN, a generative AI-powered system that automates the review and extraction of relevant information from legal documents. This system streamlines the time-consuming process of document review, improves accuracy, and reduces operational costs.

DBS Bank - NAV Planner: DBS Bank utilises generative AI algorithms in their NAV Planner tool to provide customers with personalised investment recommendations and financial planning insights. This AI-driven approach helps customers make informed investment decisions tailored to their financial goals and risk profiles.

These examples illustrate the transformative power of generative AI in redefining customer experiences in the banking sector:

Looking ahead, emerging generative AI technologies that hold promise for the future of customer journeys and are poised to revolutionise how customers interact with banks are voice assistants, augmented reality, and advanced analytics. However, the potential applications of generative AI in enhancing customer journeys extend beyond these areas. Let's explore additional angles where generative AI can transform the banking industry:

Banks should approach the adoption of generative AI in customer journeys strategically and responsibly. It is essential to prioritise areas that don't pose financial risk to customers, such as onboarding processes, personalised product recommendations, and customer support. By starting in these less risky areas and gradually expanding into other domains as the technology matures, banks can gain valuable insights, measure the impact, and refine their generative AI initiatives. This iterative approach ensures a balanced integration of generative AI, upholding ethics, data privacy, and maintaining a human touch alongside the AI-driven experiences.

In conclusion, generative AI has the potential to revolutionise the banking industry by providing personalised customer experiences and streamlining operations. Banks can unlock new value through improved efficiency, expanded market access, and enhanced customer lifetime value by leveraging generative AI in their customer journeys. With the ability to analyse data, offer personalised recommendations, detect fraud, provide contextual insights, and anticipate customer needs, generative AI empowers banks to deliver exceptional experiences. By experimenting with generative AI in prioritised areas and expanding as the technology evolves, banks can harness its full potential and drive innovation in the digital era.

Struggling to identify where and how to incorporate generative AI into your business strategy? Mobiquity's DECODE AI immersive 1-day ignition workshop helps you to delve deeper into the possibilities of gen AI and gain valuable insights along with actionable results. Walk away with a tailored portfolio of gen AI opportunities for your business, along with a detailed execution plan to drive real business value.

Sign up for the DECODE AI workshop

References