With over 100 million millennials and tech-savvy young people in the Middle East, where over 50% of business owners are under the age of 35, Bank ABC saw the need to give this generation of consumers an easier way to manage their finances. The idea was to create an entirely new, fully-digital banking solution.

By developing holistic personalised financial solutions built around customer needs and aspirations, and aligning products and services around their lifestyles, Bank ABC aimed to give customers easier tools and resources to achieve their financial goals.

To do this, the team had to overcome a few key challenges, including:

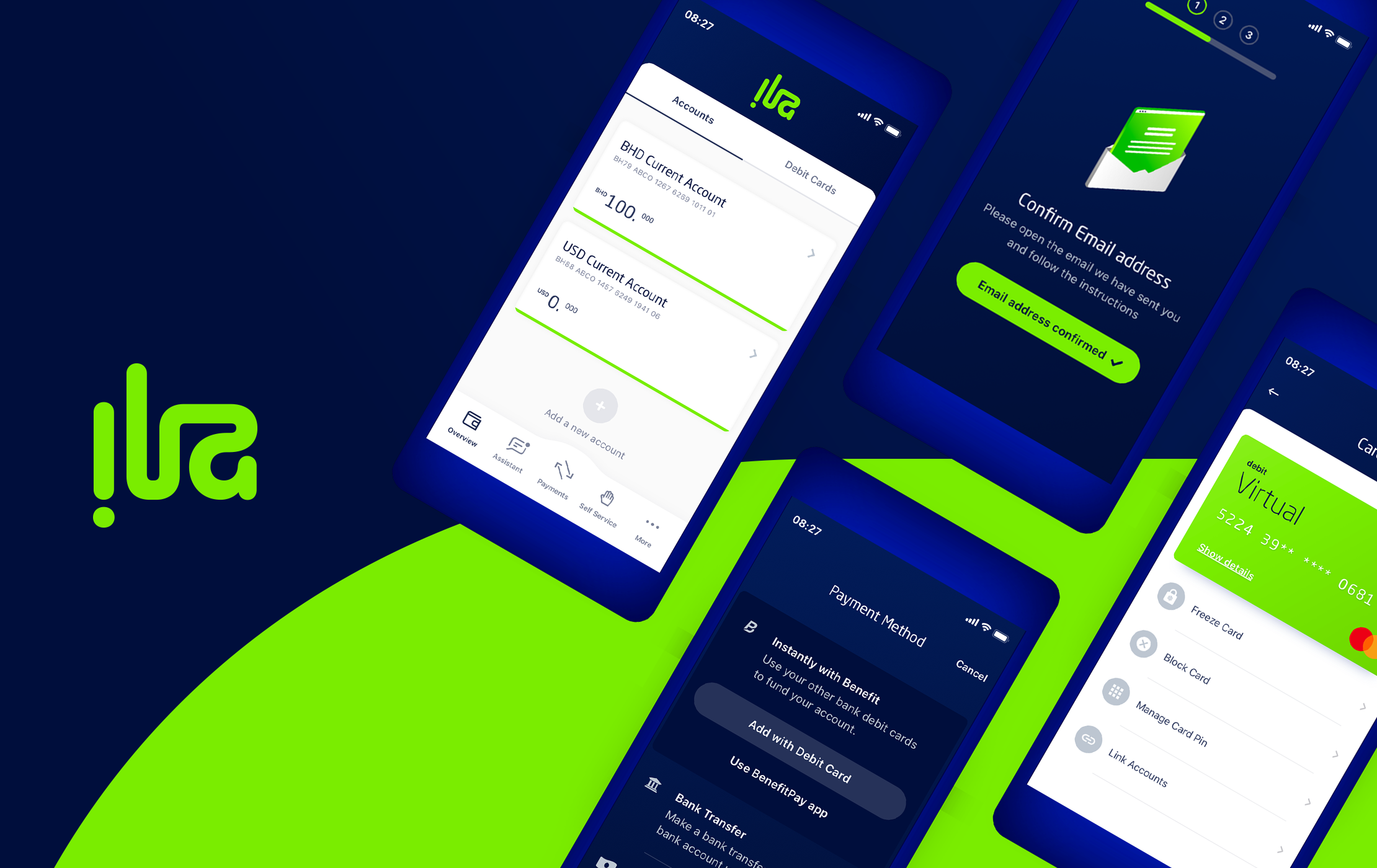

Bank ABC worked with a team of strategists, creatives, and engineers to envision and create ila. The team proudly built the first cloud-based, digital bank in the Middle East to meet the ongoing demand from its growing population of young people. The ila team's focus was always about creating a customer-centric solution that would help people with their entire financial health, going beyond banking.

The team started by defining an initial value proposition and enterprise architecture design for delivering the bank. This level of strategy and planning helped everyone uncover any friction in the process so that they could be addressed and accounted for when building the digital bank.

Part of the ila project was built with Backbase, the leader in digital-first banking software. The Backbase platform brings together data and functionality from traditional core systems and new FinTech players into a seamless, omni-channel experience.

As we moved through the project, we focused on the customer, adding features that would make every person feel special and rewarded.

At all levels, from start to finish, Bank ABC ensured that ila was much more than a digital bank. Rather, ila provides the next wave of technology to support Arabians in their everyday life.

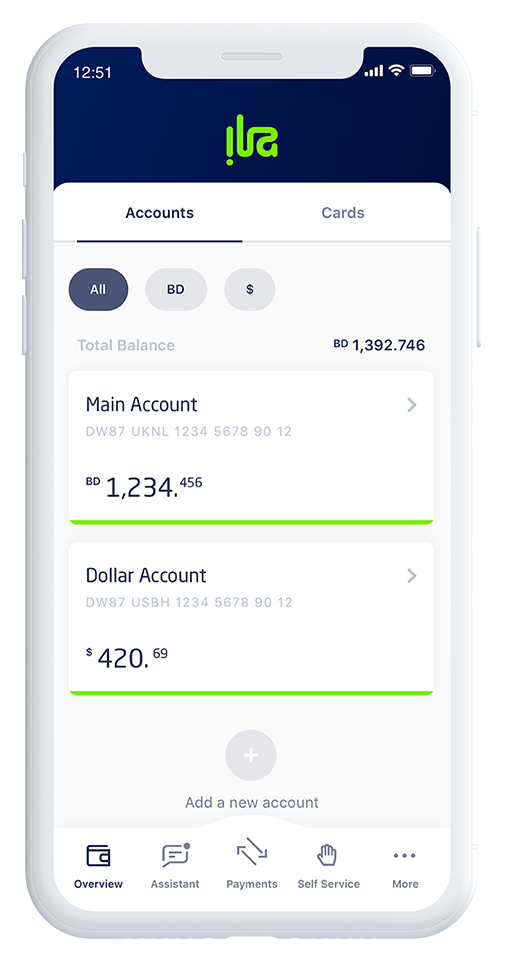

The Mobiquity team is honored to have been a part of the ila project, with the end result of providing users with a clear overview of their finances. The neobank also provides the tools to reach goals for saving, and it has an easy way to set budgets. Other unique features include splitting bills, made easy with simple payment requests from the app. And if customers need advice, the in-app smart chat assistant is available 24/7.

All of these features will change the way young people in Bahrain experience banking. The commitment from Bank ABC around innovation is sure to kickstart digital transformation trends for multiple businesses in this region, and we look forward to seeing what the future holds for years to come.

Download the Ila Bank client case study:

Learn from our other client case studies:

Our hyper-collaborative team is proud to have been part of such an amazing project. We asked some of the team members to share their thoughts about their experience working on ila.

|

Paul van Raak, Creative Lead

|

|

Thierno Diallo, VP Client Delivery |