Founded 1851, Bank of the Philippine Islands (BPI) is the first bank in Southeast Asia. One of the leading banks in its home country, BPI has over 800 branches nationwide and comprehensive services that include consumer banking and lending, asset management, insurance, securities brokerage and distribution, foreign exchange, leasing, and corporate and investment banking.

BPI’s 169-year history shows a legacy of innovation and a reputation for being at the forefront of technology. As the first to introduce an online banking platform in 1999 and a mobile app in 2009, BPI has consistently proven itself as a digital trailblazer.

Mindful of its heritage as the Philippines’ pioneer bank, BPI has always been ahead of the curve, continually introducing new and relevant innovations that empower Filipinos. Today, BPI remains committed to innovation that matters, and has selected Mobiquity as its digital banking partner.

BPI needed to upgrade its digital banking platform to align to its mission to create an enhanced customer experience. The goal was to simultaneously drive customer engagement, and create an omnichannel experience with their branches. Devising a “phygital” strategy that cuts across all platforms and serves all types of clients, online or offline, was seen as the necessary first step. BPI Chief Operating Officer Ramon Jocson summed up this idea when he said: “We need to do this to stay relevant. We want to make sure we are part of everything you do every day.”

Bringing this idea to life required a cutting-edge, agile solution – one that could reduce time-to-market and let the bank respond faster to users’ needs while keeping pace with changing technology.

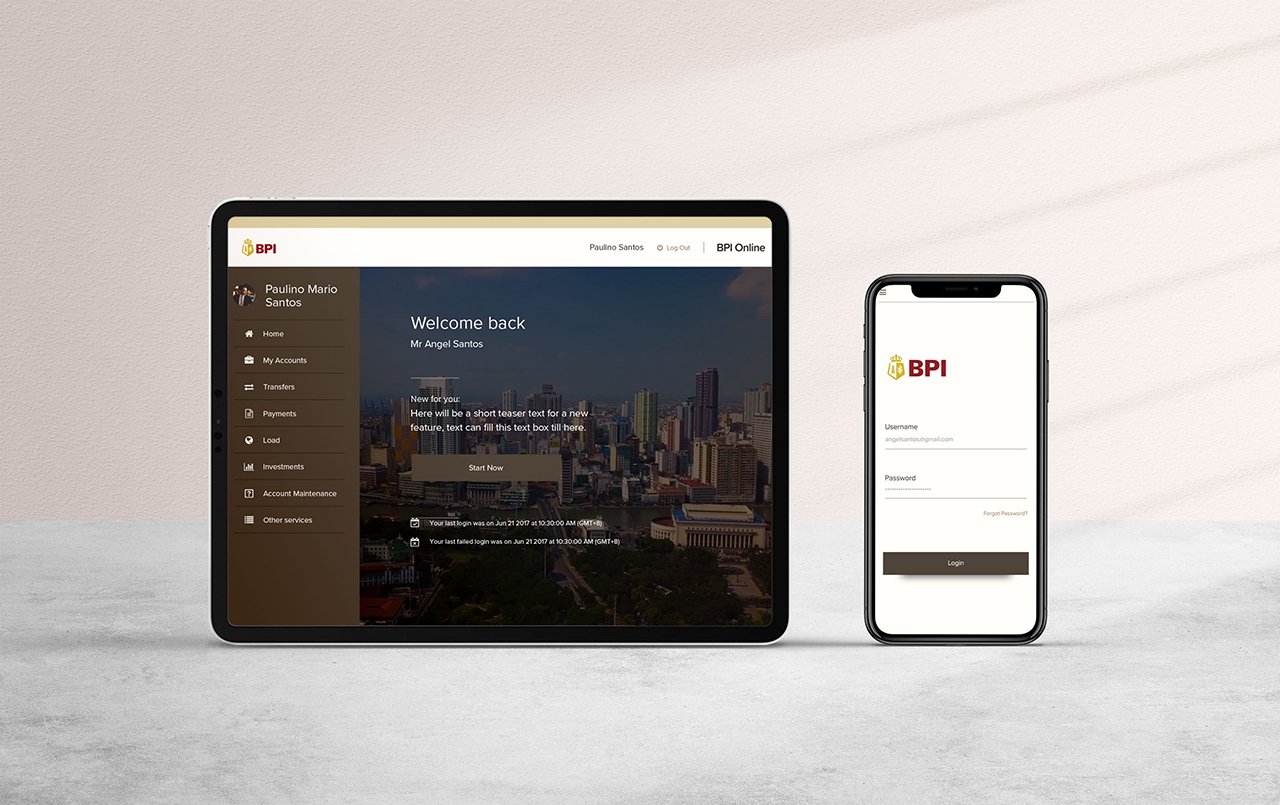

To create the seamless digital banking experience the bank wanted for its customers, BPI partnered with Mobiquity and Backbase to go-live with both an online portal and mobile banking offering. After assessing what BPI already had in place, Mobiquity architected and implemented the Backbase platform to enable digital banking. Together with Mobiquity, BPI launched its first MVP (Minimum Viable Product) in record speed – within 6 months.

After successfully re-platforming the first MVP, Mobiquity implemented new functionalities in incremental releases. Mobiquity also rebranded BPI’s institutional website to align better with the new online banking platforms to deliver a consistent user experience across all channels.

The faster go-to-market strategy enabled features to be released to the public in a regular and prompt manner. Each feature has been designed to help, engage, and provide clients with the power to do their banking whenever and wherever they are. Some highlights introduced:

Digital transformation is an integral part of the bank’s strategy to employ innovation and quick go-to-market that ensures a continuous release of services and features. Together with Mobiquity, the team has become adept at producing diversely relevant, convenient, and pioneering features to suit their clients’ varying needs.

While the first and second years of the engagement were focused on improving features, moving from the old platform to the new one, and rolling out a fresh design of their public-facing website, the main focus in 2020 and beyond is the implementation of new revenue-generating features and the addition of new partnerships to BPI’s growing ecosystem to boost the use of digital banking among BPI’s customers.

BPI continues to add inventive features to uplift the clients’ digital lifestyle. BPI also boosted its digital ecosystem by engaging in partnerships and offering services beyond banking. This helped BPI to gain the most extensive list of digital capabilities among local banks, with 70 online and 40 mobile banking features.

To date, BPI Online has hit the 4 million mark for enrolled users, a huge leap from end-2017 with 2.9 million users. The number of users grew by 14% in 2018 and 10% in 2019, while transactions surged by 87% in 2019. The huge spike in transactions indicates the shifting behavior towards online banking.

BPI Chief Operating Officer Ramon Jocson said, “Digital transformation is not just about applying technology tools. It is about changing the way we think of ourselves and our place in customers’ lives. With our digital ecosystem, we are trying to influence our clients to adopt digital behaviors and develop a digital culture.”

Most recently, the COVID-19 pandemic and lockdowns in large swaths of the Philippines accelerated the shift towards digital banking among BPI’s clients. In the first month that the main island of Luzon, where much of the country’s economic activity is centered, around 90% of all transactions by BPI customers were done digitally. Prior to the pandemic, 60% of transactions were handled by branch staff, while only 40% were done via BPI Online or the Mobile App.

“The mobility limits and strict social distancing guidelines in place ushered the emergence of a vibrant hyperlocal market in many parts of the country. Communities organized and created social media groups for their respective neighborhoods where they could freely advertise homemade goods and offer fresh market products. Our digital platforms helped enable their activities by giving them a safe and secure contactless payment system,” said Noel Santiago, BPI Chief Digital Officer.

Through its digital transformation, BPI aims to become the Filipino’s everyday bank.

Download the BPI client case study:

Learn from our other client case studies: