Property and casualty insurance is all about protecting the things that matter most in a person’s life – their families, homes, and businesses. It’s a simple concept that isn’t always simple to manage.

From paying a bill, to opening a claim or changing a policy, everyday tasks are often complicated by the manual effort required.

That’s why our client, a top US property and casualty insurance company with a mission built around caring for their customers, recently increased their digital strategy investment. They set a simple vision for their mobile app: “To give our customers a 5-star mobile experience that helps them easily manage and protect the things that matter most.”

To create a mobile app that was meaningful for users, it needed to transition from policy-centric interactions to customer-centric experiences.

The first step in bringing our client’s vision of a 5-star mobile app to life was understanding the existing gaps in customer experience and revamping the digital product accordingly.

A few key places quickly emerged as focus areas. First, the client’s mobile app was originally designed as an extension of their website, which made it difficult to use, especially for mobile-first customers. Secondly, our client had a strong focus on policy, but for customers, finding policy information they needed was not intuitive. The solution needed to frame the customer’s coverage in terms of what was being insured and less around the way that the insurer classified policies internally.

Lastly, our client knew that their mobile app ratings and reviews could have an impact on their brand and they needed support around how to use this customer feedback to create a better experience.

As our client evolved its thinking around digital, they knew they needed a technology partner that could work with their team to improve the app’s functionality, helping achieve silent utility – meaning the app “simply works.”

Mobiquity was selected as a partner after the team presented its findings from the Mobiquity Friction Report. This proprietary tool leverages artificial intelligence and machine learning to analyze thousands of reviews and ratings to help companies quantify what’s working well and where there is room for improvement.

With these insights, our client was confident in Mobiquity’s approach to mobile app development and trusted our ability to put their customer at the center of the mobile app experience. Built on AWS, the new and improved mobile app included:

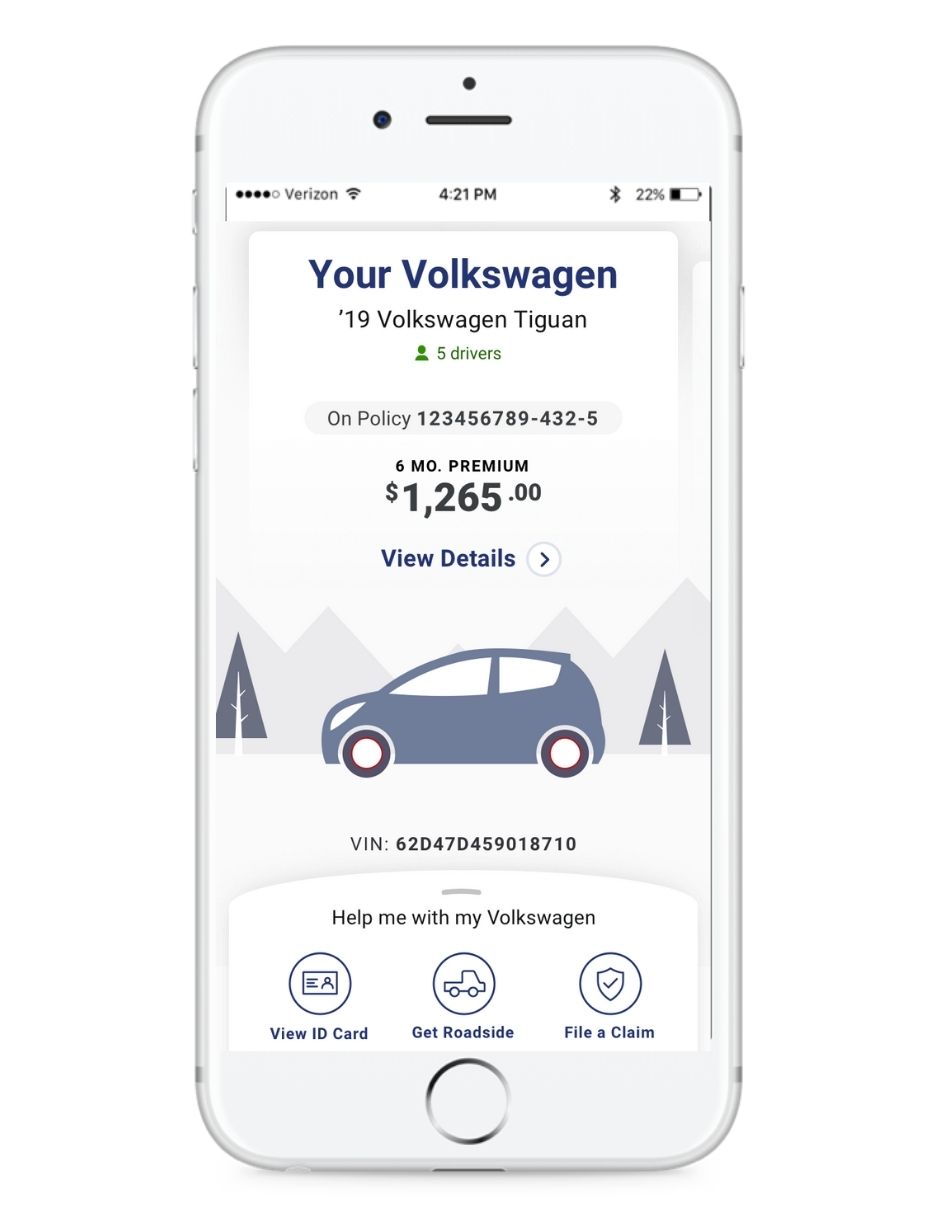

Transition from policy view to personal view

Moving from a view that was all about policy to one that showed the personal items specific to each customer was crucial. Mobiquity incorporated direct feedback from customers into this component of the engineering and design.

We brought this to life by designing and implementing clear visualizations of the items being viewed, such as a car for an auto insurance policy or house for homeowners insurance. We also listed each item in big, bold font rather than having them identified solely by policy number.

Now, if a customer is insuring a Honda CR-V, the name “Honda CR-V” appears in the app and the policy number is featured in a smaller font below the item name. This eliminates confusion, especially for customers who insure more than one item and are not sure which policy number is associated with each item.

User interface design

Together, we created an extension of the insurers brand with a more intuitive, user-friendly interface. The idea was to create a mobile tool that fit seamlessly into customers’ lives and matched the user experience of their favorite apps while also maintaining our client’s overall brand aesthetic.

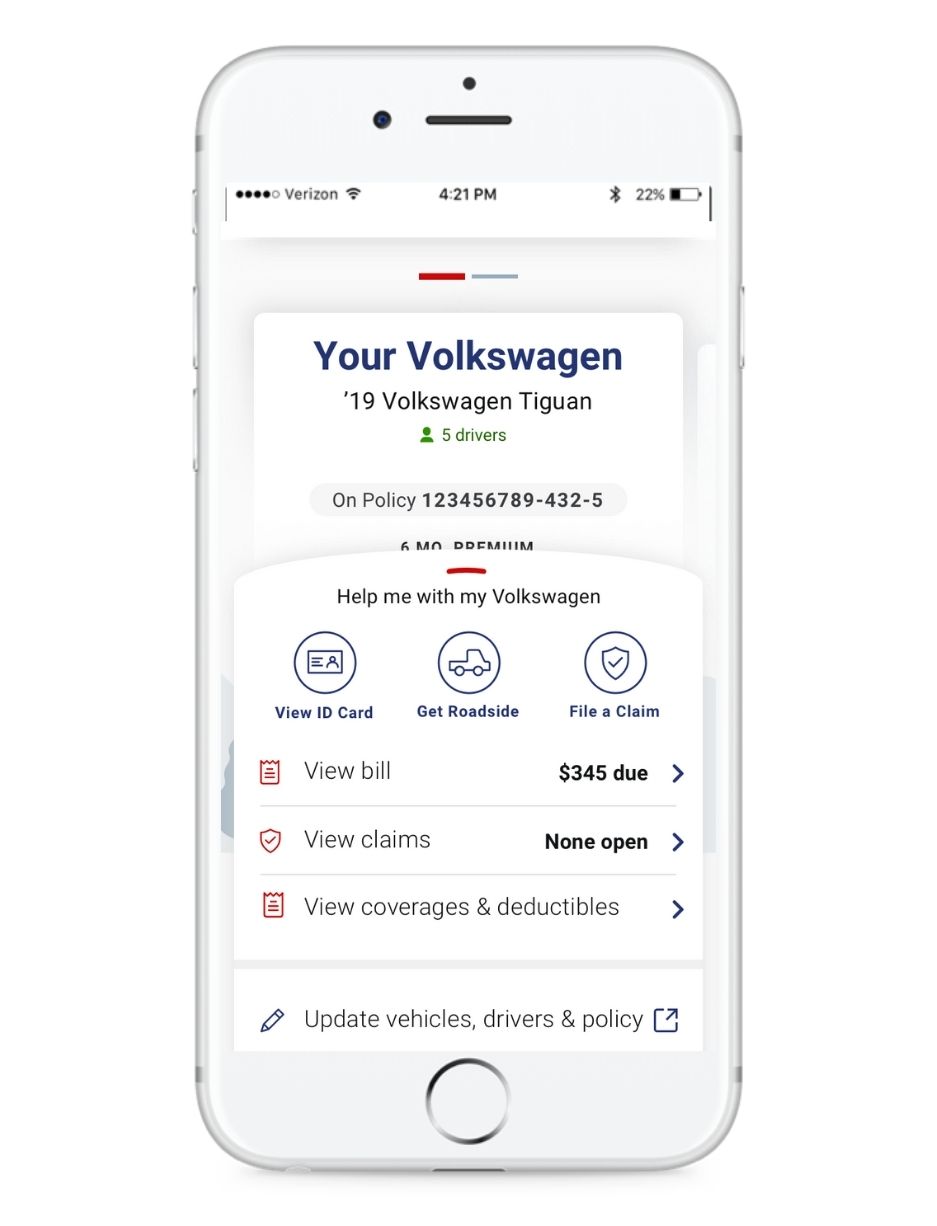

One of the most important features to improve was the home screen dashboard. Mobiquity designed the home screen to offer easy access to customers’ items via a carousel menu and also included a contextual menu that enabled users to take quick actions. Research indicated that these quick actions mattered most to customers, including:

From the home screen dashboard, we made sure customers could also see notifications regarding updates or actions that they need to take to manage their account. Users can also pay their monthly bill straight from the home screen. This is among the top reasons users engage with the app, and is now easy to find and simple to complete.

.png)

Improving login while keeping security in tact

Mobiquity has found that across all mobile apps, login is a consistent challenge. To reduce friction with login with our client’s app, it was enabled to recognize biometrics such as Face ID or fingerprint. In addition, once users are logged in, they remain logged in for eight hours. If a user switches to another app and then comes back, they do not need to login again.

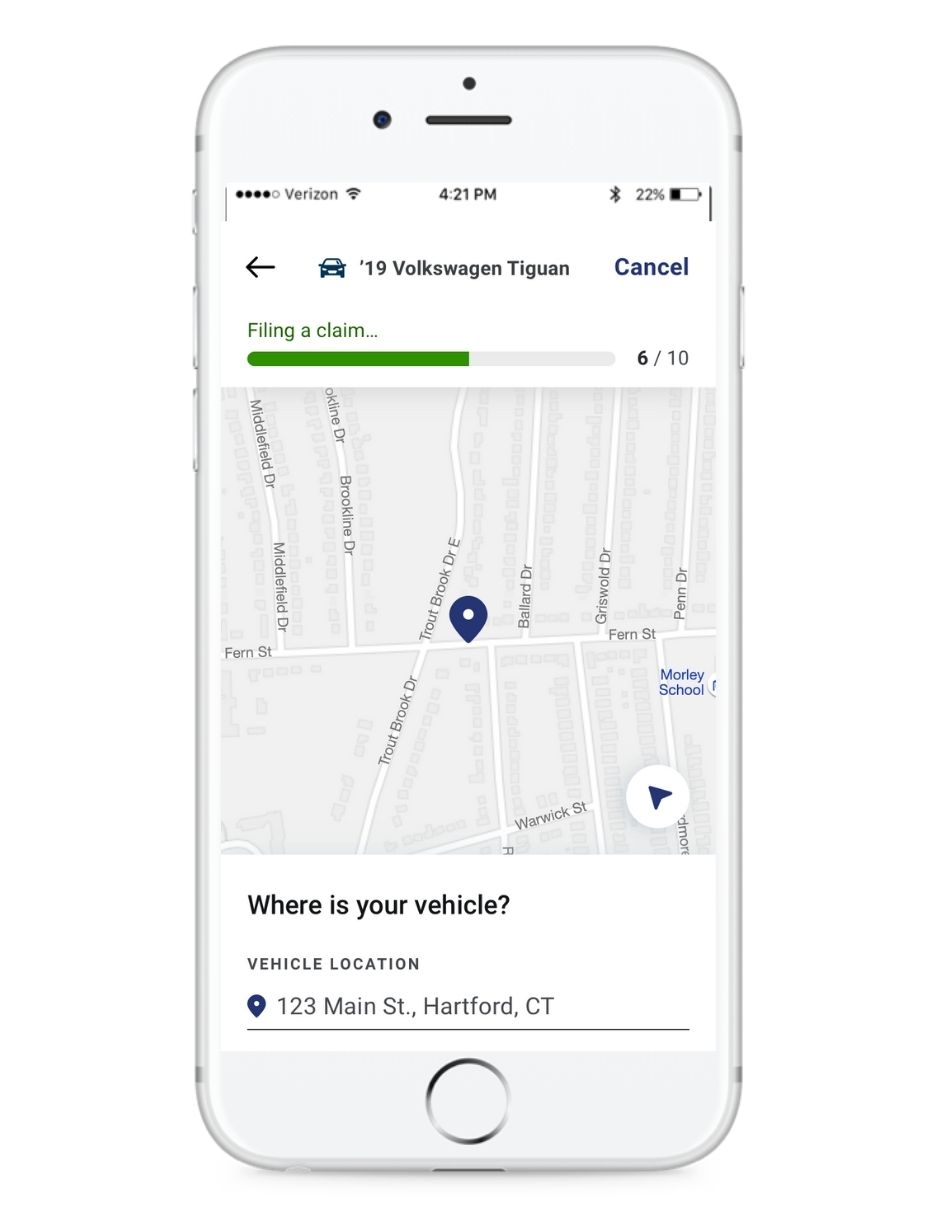

Elevating the in-app claims experience

The claims department in an insurance company is often the largest, and for customers it’s the aspect of insurance that can be the most stressful. Filing a claim usually means calling your insurance company, providing information, waiting, following up, and more waiting and wondering. To ease this process, the claims process was simplified so that users could file a claim right inside the app. The app was also integrated with third parties, such as a glass replacement firm and roadside assistance company, to reduce friction.

Key AWS Tools

Leveraging the power of AWS was an important part of this project. Cognito was used to improve the login experience by enabling single sign-on through SAML. This was backed by Lambda functioning that interacts with domain servers hosted on-premise. DirectConnect was used to establish private, secure connectivity between AWS and the insurers on-premise devices. These back-end services all aid in making in-app functionality easier, allowing users to navigate seamlessly from one page to the next. But in addition to functionality, keeping sensitive user information secure was very important. AWS Cloudwatch and Cloudtrail were both utilized to monitor account activity, automatically log events, and quickly resolve any security issues, thus simplifying compliance.

After launching the app, our client received great feedback from customers. With a 4.6 star rating, customers are very satisfied with the updated experience, noting the ease of Touch ID, ability to access their digital insurance card, and the usefulness of filing a claim and requesting roadside assistance.

.png?width=1110&name=Travelers%20Case%20Study%20Header%20(1).png)